UNIQUE PROCESS

“Getting started is the first and most important part of any journey. We help you get off to a good start by assessing where you are now and work with you to discover where you are trying to go.”

-Brad Manthey

FINANCIAL SERVICES

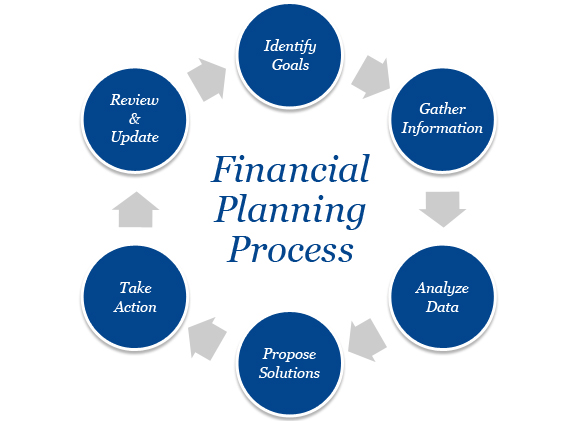

Financial Planning is the process by which one systematically builds and manages wealth over time, in order to pursue financial freedom. We define financial freedom as having enough capital to perpetually generate ones desired income.

AREAS OF FINANCIAL PLANNING

LFG will examine the following areas as part of our working relationship

Financial Position – An analysis of your present situation with recommendations on eliminating debt and maximizing cash flow

Financial Position – An analysis of your present situation with recommendations on eliminating debt and maximizing cash flow

Protection Planning – Complete analysis on your life insurance, short and long term disability policies, and Long Term Care plans

Investment Planning – A review of your current investments to make certain they support your financial goals and risk tolerance, with recommendations on building a portfolio tailored for you

Retirement Planning – A plan to help you identify your savings requirement and asset accumulation needs based on an analysis of retirement income and expenses, planned distributions and healthcare needs.

Income Tax Planning – A projection of your current and future tax liabilities, examining your investments for tax inefficiencies and working with your tax professional if desired

Legacy Planning – Strategies to help you distribute your assets on your terms, both during and after your lifetime, making certain your financial goals are not hindered and your intentions are realized

Education Planning – Strategies for both K-12 and post secondary educational costs

AREAS OF FINANCIAL PLANNING

LFG will examine the following areas as part of our working relationship

Financial Position – An analysis of your present situation with recommendations on eliminating debt and maximizing cash flow

Protection Planning – Complete analysis on your life insurance, short and long term disability policies, and Long Term Care plans

Investment Planning – A review of your current investments to make certain they support your financial goals and risk tolerance, with recommendations on building a portfolio tailored for you

Retirement Planning – A plan to help you identify your savings requirement and asset accumulation needs based on an analysis of retirement income and expenses, planned distributions and healthcare needs.

Income Tax Planning – A projection of your current and future tax liabilities, examining your investments for tax inefficiencies and working with your tax professional if desired

Legacy Planning – Strategies to help you distribute your assets on your terms, both during and after your lifetime, making certain your financial goals are not hindered and your intentions are realized

Education Planning – Strategies for both K-12 and post secondary educational costs